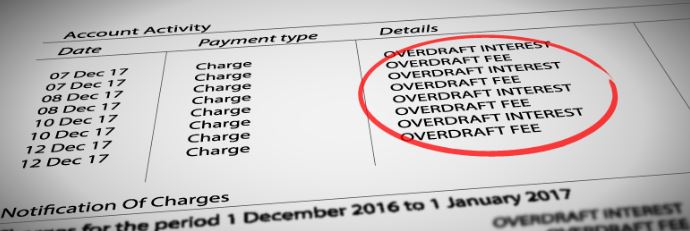

Calls to ban excessive overdraft fees

UNARRANGED overdrafts which come with high fees can see individuals sometimes paying back ten times more than they originally owed are set to be scrapped.

The Financial Conduct Authority (FCA) has said banks and firm last year made over £2.4 billion from overdrafts, a third of this amount coming from unarranged overdraft fees.

Andrew Bailey, chief executive of the FCA said: ‘Today we are proposing to make the biggest intervention in the overdraft market for a generation. These changes would provide greater protection for the millions of people who use an overdraft, particularly the most vulnerable…”

“We are proposing a series of radical changes to simplify the way banks charge for overdrafts and tackle high charging for unarranged overdrafts. These changes would make overdrafts simpler, fairer, and easier to manage.”

The FCA is also looking at banning fixed fees for borrowing through an overdraft. It also said that rates must be advertised in a clearer way and that banks must do more to help customers struggling with their finances.