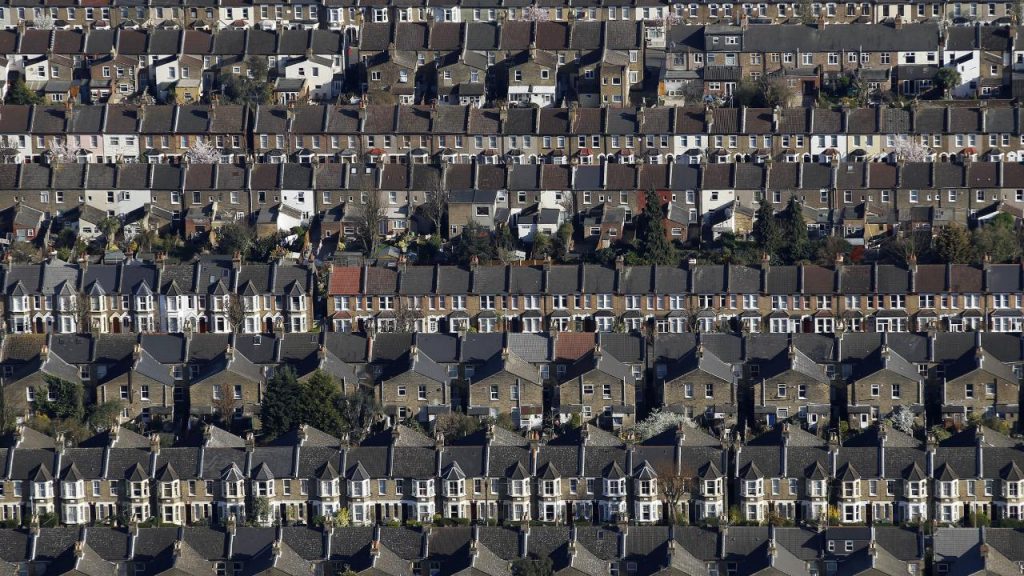

Top 10 Areas in England Most at Risk of Home Repossessions – 8 Are in London

8 out of the top 10 areas in England most at risk of home repossessions are in London.

New research has identified the areas in England most at risk of home repossessions, with Enfield placing first.

The research, conducted by legal experts Lawhive, analysed data from the Ministry of Justice on the number of home repossessions per local authority in the third quarter of 2024. The figures were compared with population data to reveal the areas where homeowners are most likely to face repossession.

Enfield tops the list with 186 recorded repossessions, equating to a rate of 55.71 per 100,000 people.

Newham ranks second, also recording 186 repossessions but with a slightly lower rate of 51.86 per 100,000 people due to its larger population.

With 105 repossessions and a rate of 47.73 per 100,000 people, Barking and Dagenham holds the third position.

Luton ranks fourth. The town, located in Bedfordshire, recorded 107 repossessions and a rate of 47.14 per 100,000 people.

Haringey is in fifth place; the borough recorded 118 repossessions and a rate of 45.07 per 100,000 people.

Slough ranks sixth. The town in Berkshire experienced 70 repossessions and a rate of 44.17 per 100,000 people.

Croydon is seventh on the list, with 173 repossessions and a rate of 44.11 per 100,000 people.

In eighth place is Hillingdon. The borough recorded 121 repossessions, resulting in a rate of 39.70 per 100,000 people.

Barnet is in ninth place, with 151 repossessions and a rate of 38.81 per 100,000 people.

Redbridge rounds out the top ten with 120 repossessions and a rate of 38.60 per 100,000 people.

Daniel McAfee, Lawhive’s UK lawyer and Head of Legal Operations, commented on the findings, “This study highlights the significant challenges that homeowners are facing in certain areas, particularly in London. Rising living costs are making it increasingly difficult for many residents to keep up with mortgage payments and other bills. It’s crucial for anyone struggling to seek legal advice early, as it can help with deferred payment plans, direct negotiation, alternative dispute resolution (ADR), and court proceedings support—potentially preventing repossession.”

For full details regarding the report visit Lawhive | Local UK Solicitors & Lawyers Online